- WHAT IS CFP?

- WHAT MAKES CFP IN-DEMAND?

- STRUCTURE OF CFP LEARNING

- INVESTMENT PLANNING SPECIALIST

- RETIREMENT AND TAX PLANNING SPECIALIST

- RISK AND ESTATE PLANNING SPECIALIST

- INTEGRATED FINANCIAL PLANNING SPECIALIST

- WHO CAN PURSUE CFP?

- WHY INFILY FOR YOUR CFP?

- FPSB FEE STRUCTURE

- WHAT ARE THE CAREER OPTIONS AFTER CFP?

- SAMPLE CERTIFICATES

WHAT IS CFP?

The Certified Financial Planner (CFP) is a US based finance charter offered by Financial Planning Standards Board (FPSB), started with a vision of making the Personal Financial Planning industry more organized and diversified. CFP certificate aims at equipping the students and working professionals with skills and intelligence required for Personal Finance Management, Risk Management, Tax Planning of a client, Investment Planning based on various desires and requirements of the client, Estate Planning and Wealth Distribution of a client, Goal Planning, etc.

A CFP professional will be responsible for helping individuals/investors in a variety of areas in managing their finances, such as retirement, investing, education, insurance, and taxes, etc. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional development requirements, clear a rigorous exam that assesses competency, and adhere to a code of ethics to work in the best interest of the clients.

WHAT MAKES CFP IN-DEMAND?

- One of the highest credentialsin Personal Financial education.

- Recognition in more than 27 territoriesaround the world.

- Covers bothIndian and Global Financial Planning concepts.

- Only certificate that provides exposure of such a wide range of aspects of the Financial Planning Industry.

- 3% incrementin the number of CFPs across India in the past year despite Covid.

- Opportunity to join a network of 203,000 CFPs world wide.

- CFP is a certificate Accredited by Indian Institute of Securities Market.

- Qualified CFPs have witnessed increased client retentionand client satisfaction.

- One can land a higher number of HNIs/HNWIs Well organized and better portfolio management.

- CFPCM mark enhances the credibility of the professionalsamongst the investors.

- Enhanced career and employment opportunitieswith financial services companies as a comprehensive education of all the personal finance services is imparted in the students.

- Increasing demandamong the MNCs and corporates.

- CFP can also work as a foundation for CFA, CWM

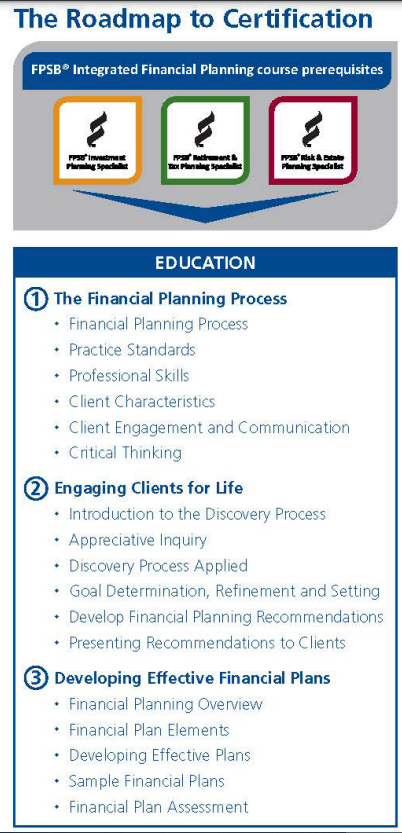

STRUCTURE OF CFP LEARNING

CFP certification is trains students in Four Key Specializations as follows:

- Investment Planning Specialist

- Retirement And Tax Planning Specialist

- Risk And Estate Planning Specialist

- Integrated Financial Planning Specialist

Based on the above specializations, the student is awarded individual specialist certificates as well so that the student can start their career in the said fields even before completion of his/her CFP certificate.

(A). INVESTMENT PLANNING SPECIALIST

The FPSB® Investment Planning Specialist course prepares you to develop strategies to help clients optimize their risk profile, financial capacity and constraints.

(B). RETIREMENT AND TAX PLANNING SPECIALIST

The FPSB® Retirement and Tax Planning Specialist course teaches you to consider your clients’ personal financial goals, risk tolerance and risk capacity, asset locations, the structure and impact of public and private retirement plans, and how taxation will affect your clients’ financial situation and goals.

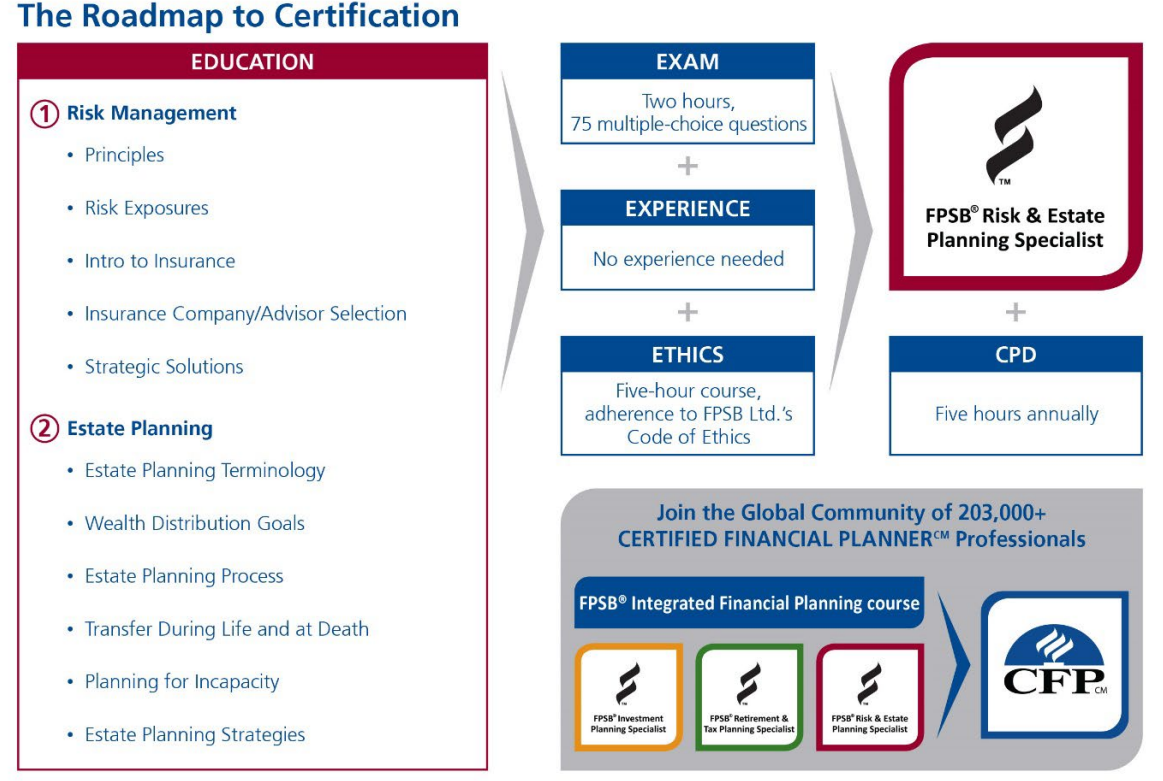

(C). RISK AND ESTATE PLANNING SPECIALIST

The FPSB® Risk and Estate Planning Specialist course provides a solid foundation of risk management, insurance planning and estate planning through real-life scenarios and examples.

WHO CAN PURSUE CFP?

- Determined MFDs, Insurance Agents, Accountants, and other working professionalswho seek growth and development in their field and desire to upgrade their work parameters, horizons, demographics, and earnings.

- 12th pass studentswho are focused and enthusiastic to develop a career in the finance industry at an early stage.

- Graduatesplanning to step a stone in Investment banking, Wealth Management, Risk Management, etc.

- Individualslooking for a career shift to personal finance, insurance or investment industry.

- Employeeswho wish to start their own advisory and take their experience and career a step ahead.

- Professionals like CA, CFA, CWMcan also study CFP for knowledge upgradation.

- Individuals from any backgroundwho simply want to enhance their knowledge for self investing or planning can also pursue CFP.

Basic Eligibility criteria to start CFP is 12th pass and 18 years of age and Eligibility for achieving the Final Charter is Graduation and 3 years of Work experience in any financial service.

A student joining CFP after HSC can start their employment based on the specialist certificates of the first three modules as well.

WHY INFILY FOR YOUR CFP?

- One of the pioneers and oldest institutes contributing in CFP Education for the past 10 years.

- We as an institute have trained more than 100,000 individualsin Financial Planning via workshops and seminars apart from our classes.

- Dedicated Live weekend sessions.

- Recordingsof every Live session.

- Extra preparatory sessionsconducted during the exams for better results of the students.

- Live doubt solving sessionsbased on the requirement and convenience of the students.

- We also provide an Online education portal for extra practiceof Question Sets and Mock Tests.

- Extensive one on one trainingfor Financial Plan Construction sessions.

- We provide soft copy of our materials such as PPTs, word files, excel of extra questions, etc. in order to keep the material relevant and up-to-date.

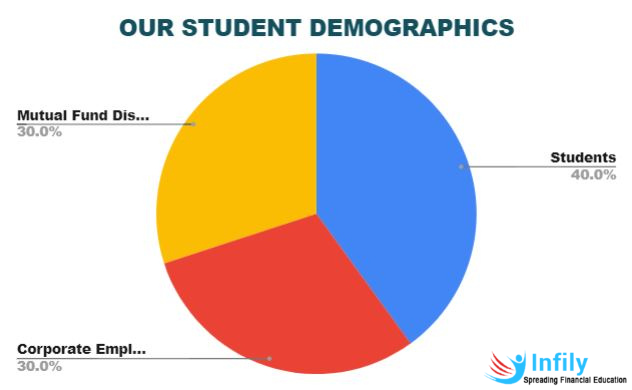

- Our student networkis a balanced mix of students, branch heads, self-employed personnel, and professional charters. They come from varied professions, cities, qualifications etc. as can be seen in the pie.

- Exclusive Internship Opportunitiesfor students based in Jaipur.

OCCUPATION-WISE DISTRIBUTION

FPSB FEE STRUCTURE

INFILY offers a $150 Discount which is adjustable in the Study Material Cost for every module, thereby making it half of the actual fee.

WHAT ARE THE CAREER OPTIONS AFTER CFP?

Besides being a Practicing CFP, a Certified Financial Planner can also have a career in any of the areas he specializes related to Investment Planning, Retirement Planning, Taxation, Risk Management, Estate, and Will Distribution, etc. Some of the career options are mentioned below:

- Financial Planner

- Wealth Advisor / Manager

- Mutual Fund Distributor

- Estate Planner

- Insurance Advisor

- Independent Consultant

- Stock Broker

- Tax Consultant / Planner

- Trainer or Coach for personal finance products

- Marketing of personal finance products

Anyone can invest in today’s era but it takes a Certified Financial Planner to develop & execute a well-researched, organized, and well thought financial plan to reduce the risk & increase the earnings.

SAMPLE CERTIFICATES

Knowledge Base

Frequently Asked Questions

Here a re a list of some frequently asked questions by our clients. if you don’t find the answer you seek, please feel free to contact us.

Yes, CFP is an excellent course for those who are looking for a career in the Financial Planning industry such as Banks, NBFCs, Financial Institutions, Wealth Management companies, Mutual Funds, etc.

With a Demand higher than Supply in India, CFP is worth pursuing.

Salary package is a very subjective matter and it varies from person to person based on their qualification, skills, experience, caliber, and interviews of course. But to provide a glimpse we can say that a well-qualified and determined CFP can earn an average Salary anywhere between 3 LPA being a fresher to 12 LPA or even more based on their skills, experience, caliber, and the value they can add to the organization, etc.

Mutual Fund Companies, Financial Planning Firms, Wealth Management Organizations, Insurance Companies, Banks.

Being a CFP, you need to analyze and assess the client or organization’s Goals and Objectives, probable areas of Risk, Income flow, assets and liabilities, debts and other problems, etc. In brief, as a CFP you must be aware of the history of the client or any vital information based on the purpose of the client.

Then, you will need to construct a financial plan that can maximize the client’s income based on well calculated risk that a client can bear.

Later, you are also responsible for the implementation and regular assessment of the plan suggested by you.

Different certifications have different needs and requirements of their own. A CA is moreover associated with the accounting and tax planning of an individual or organization. CFA is moreover inclined in Financial analytics and advisory for corporate clients. Whereas a CFP deals with the entire Personal Finance Planning of an individual one-on-one.

CA and CFA are more time-consuming and tougher compared to CFP. One needs higher dedication and rigorous day and night study for years to clear CA and CFA charters whereas CFP can be completed in a way lesser time duration than the former.

It can take anywhere from 12 to 14 months to clear CFP if studied with focus and dedication.

CFP is not easy but with a little dedication, discipline, consistency, and regular training, anyone can clear CFP.

If you are a student and good at studies you may try self-study. But being a working professional, it can be tougher to clear exams via self-study. Though it is always advisable to choose the right mentor to study this course as apart from bookish knowledge their experience and vision can add more value to your CFP and it also helps to complete the course on time.

The current number of registered and authorized CFPs in India was approx. 2000 in the year 2020. This number increased by 17.6% and reached around 2,338 last year. As against this, there is a demand of around 100,000 well-qualified CFPs in India.

Hence, for a well-qualified and well-deserved candidate, there is always a great scope and opportunity awaiting him/her.

The answer is No. Though CFP is recognized in more than 27 countries, one cannot work in other countries based on their own country CFP as the laws and compliances, taxation system, investment schemes etc. are different in different countries. In your study as well, the half of the study material will be of Indian content to make you more competent and excellent for working in India.However it is always advisable to communicate with the board (FPSB) for better clarity & confirmation on this.

Testimonials

Contact

Orientation

Kindly fill up the form to Join a one hour online live session on CFP Program which includes Scope, Process, Fees and gives you an opportunity to have your all Queries answered regarding the program. Session Details will be shared individually. So, let’s Connect!